|

|

#1 |

|

Участник

|

dynamicsax-fico: Parallel accounting according to the “Cost of Sales” and “Nature of Expense” accounting method (4)

Источник: https://dynamicsax-fico.com/2016/07/...ting-method-4/

============== C.5. Production of goods Probably the most complex part when it comes to setting up the COS and NOE method in parallel is related to the production of goods. That is mainly because the production posting setup does not only require a setup of the inventory posting matrix but – depending on the parameter setup – also makes use of other accounts that are setup e.g. at the resource level, production category level and in the costing sheet. Notes:

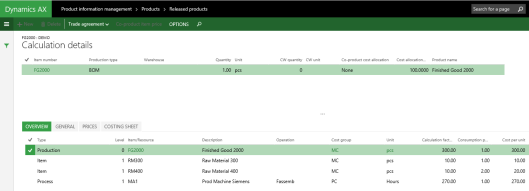

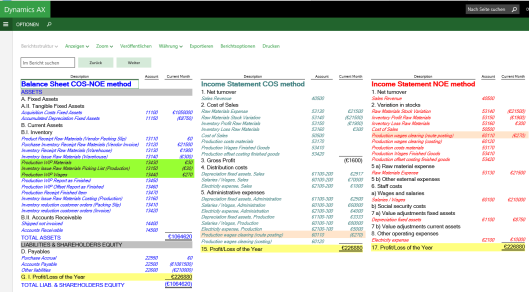

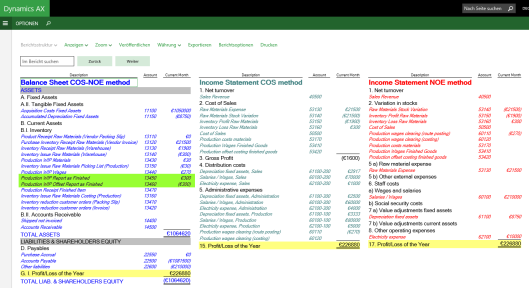

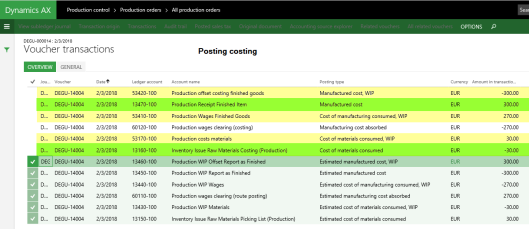

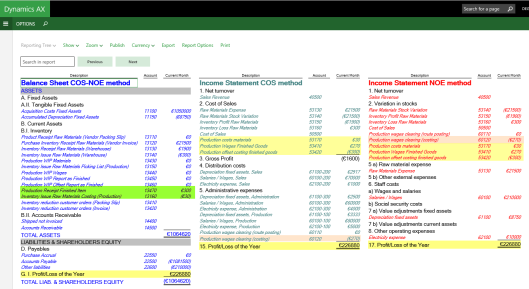

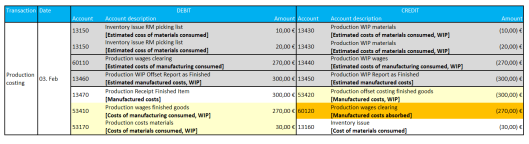

The structure of the production item I referred to above can be identified in the next screen-print.  The cost price calculation screen shown above illustrates that the production item (FG2000) consists of two raw materials (RM300 and RM400) that have a cost price of 10 EUR / pcs each. For the production of this good one piece of the first raw material (RM300) and two pieces of the second raw material (RM400) are required. In addition, for the assembly of the product a worker has to work one hour on a machine that has a total cost price of 270 EUR / hour. Based on those data a total production cost price for the production item of 300 EUR / pcs arises. C.5.1. Production step 1: Start For reasons of simplicity, the production parameters used in this example have been setup in a way that the material consumption (BOM) and route consumption are immediately posted when the production is started. The next screen-print shows the vouchers that have been created through the posting of the BOM and route journals.  The effect that these vouchers have on the financial statements of the company can be identified in the next illustration.  From a Balance Sheet perspective, the production start related postings are reflected in changes that can be observed on the WIP accounts no. 13430 and 13440. For the raw material consumption another Balance Sheet account (no. 13150) has been used as the offset account and the offset account for the route consumption has been posted on an Income Statement account (no. 60110). Given that the NOE accounting method typically uses stock variation accounts for each and every change recorded in the company’s stock level, the question arises how the raw material related postings that were executed with the start of the production order can be explained / justified? I will try answering this question based on the following illustration that shows the recorded accounting transactions in the upper part and the missing “in between” stock variation accounts in pink color in the lower part.  What becomes obvious from this illustration is that the approach followed here is not fully correct in the sense that the pink transactions highlighted above are missing. An important question at this point is whether those missing transactions result in a critically wrong illustration of a company’s financial position or not. From the author’s perspective the “missing” pink transactions are not critically important as they do not distort the financial position of a company that follows the NOE accounting method. That is because the NOE Income Statement does on the one hand side summarize all stock variation transactions into a single line. On the other hand side, one has to remember that the pink highlighted lines add up to zero and do thus have no impact on the company’s financial position. The second transaction I would like to discuss in more detail here is the route related voucher that credits an Income Statement account (no. 60110 “production wages clearing”) and thus affects the profit of the company. From a NOE accounting perspective this account / transaction can be explained by stating that the clearing account used represents a part of the stock variation of the company. In other words, the increase in semi-finished products for the route consumption part on account no. 13440 is offset by the “stock variation” recorded on account no. 60110. For that reason, the production wage clearing account has been assigned to the stock variation section in the Income Statement that follows the NOE accounting method. If you take a look at the Income Statement that follows the COS method, you can identify that the very same account no. 60110 has been included in the section that incorporates the production wages recorded before. Irrespective of the whether the name and the section where those accounts have been assigned to is correct, the question that arises how one can justify the assignment of the production wages clearing account there? From the authors perspective this assignment can be justified by interpreting the transaction recorded on the production wages clearing account as a kind of allocation that shifts a part of the total production wages from the company’s Income Statement into its Balance Sheet. Stated differently, the production salary / wages posting recorded before immediately reduces a company’s profit. The start of the production on the other hand side creates a tangible value for the company in form of a (semi-) finished product and thus increases its overall wealth. This wealth increase is reflected on account no. 60110 in the company’s Income Statement. C.5.2. Production step 2: Report as Finished (RAF) The next production step consists of reporting the production as finished. Executing this production step results in the following voucher that debits and credits a Balance Sheet account with the total production cost amount of the item.  As only Balance Sheet Accounts are used for recording the RAF transaction, no difference between the COS and NOE method arises.  C.5.3. Production step 3: End the production order The last production step ends the production order and ensures that the realized production costs get posted. Dynamics AX realizes this by reversing and replacing all prior production postings that have been recorded based on planned cost values with postings that are based on realized ones, that is, actual cost values. In the example used, the following costing voucher results.  Note: The lines that have been selected in the prior screen-print reverse the prior postings that have been created during the first two production steps. The outcome of the production postings generated can be identified in the financial statements illustrated next.  Interpretation of the production costing posting created Lines highlighted in light green color * The amount of 300 EUR recorded on ledger account 13470 represents the stock increase resulting from the production of the finished good. * The negative amount of 30 EUR that Dynamics AX credits on ledger account no. 13160 represents the reduction in raw materials that have been used for producing the finished good. Lines highlighted in yellow color * The three ledger accounts no. 53420, 53410 and 53170 are Income Statement accounts that – from an overall perspective – offset each other. That is, the total amount posted on those accounts adds up to 0 EUR. * A first reason why these accounts were setup this way is to get the production costs – of 270 EUR for the production worker and 30 EUR for the raw materials consumed – transferred into the cost accounting module for subsequent cost analysis. * A second reason for using this specific production posting setup is related to the NOE method as the accounts highlighted in yellow color represent stock variation accounts. The next illustration exemplifies this in detail by showing that those accounts are used “in between” each and every stock transaction.  Lines highlighted in white resp. orange color * The lines highlighted in white color in the first screen-print of this section – resp. the orange line in the illustration above – shows the production costing voucher which posts 270 EUR on ledger account 60120 that arose for the assembly of the production item. * As explained further above, from a NOE perspective, this account represents a stock variation and is consequently included in the cost variation section of the company’s Income Statement following the NOE accounting method. * For the COS method reference can also be made to the interpretations from production step 1. That is, the amount recorded on ledger account 60120 represents an amount that allocates costs from the company’s Income Statement into its Balance Sheet and offsets the value increase caused by the production of the finished good. To be continued in part (5) Filed under: Accounts Payable, Accounts Receivable, Fixed Assets, General Ledger, Inventory Tagged: Cost of Sales Method, Nature of Expense Method, Posting setup, Profit & Loss Statement Источник: https://dynamicsax-fico.com/2016/07/...ting-method-4/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

|