|

|

#1 |

|

Участник

|

dynamicsax-fico: Project related intercompany cost allocations (3)

Источник: https://dynamicsax-fico.com/2016/11/...allocations-3/

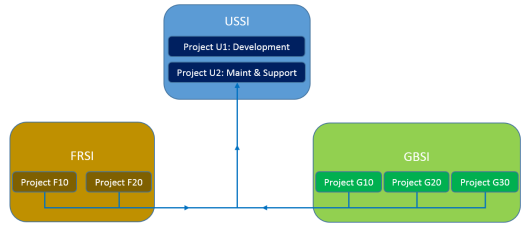

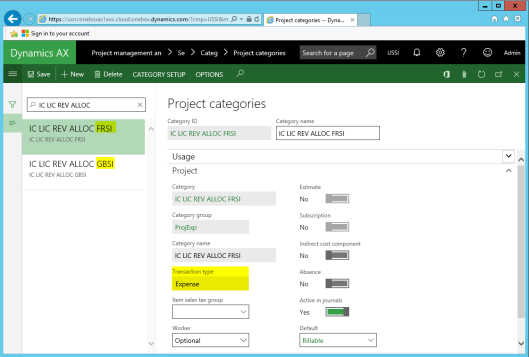

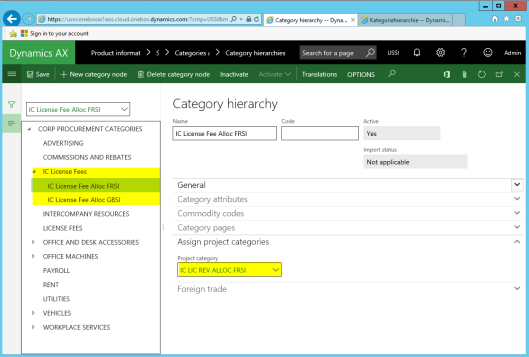

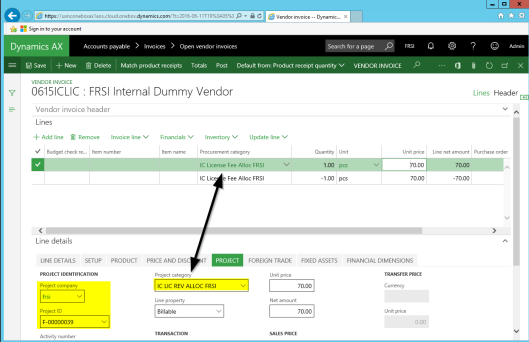

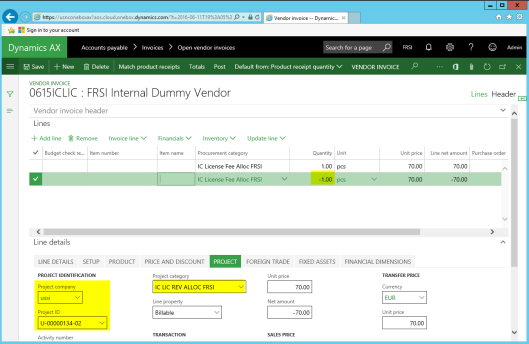

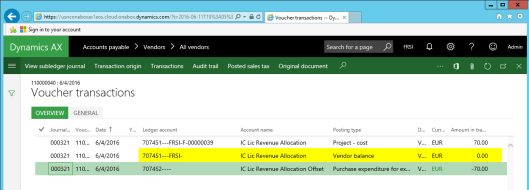

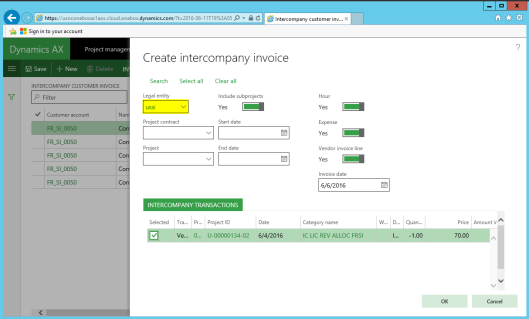

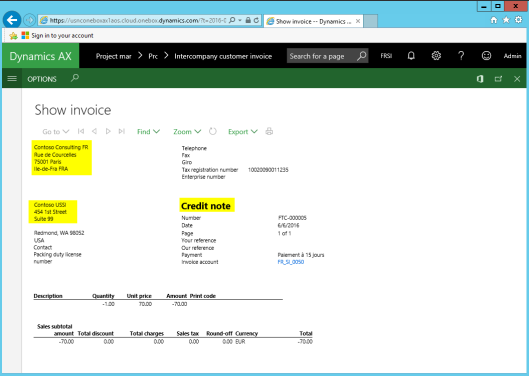

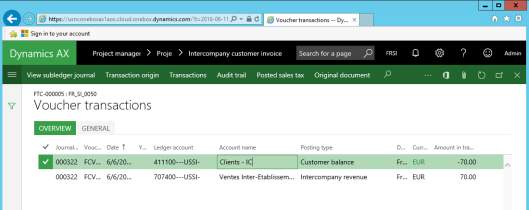

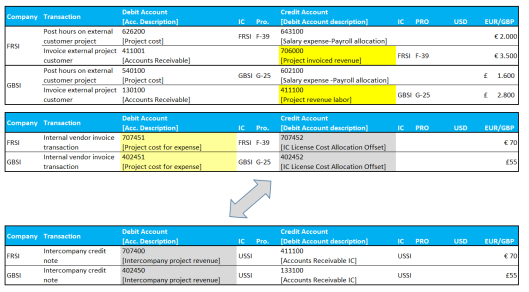

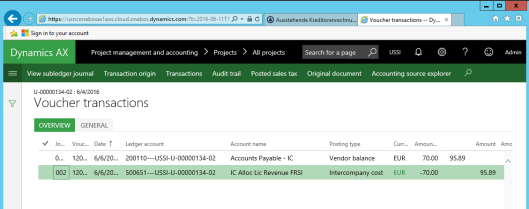

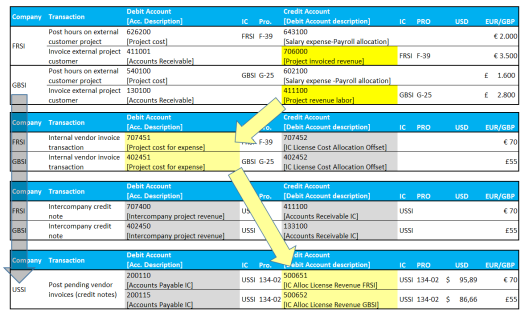

============== Example 3: Revenues realized at the subsidiary level are allocated back to the corporate headquarters level Part A: Scenario The underlying scenario for the subsequent illustrations and explanations is the development of a software product by the corporate headquarter company that requires regular updates and maintenance e.g. in order to comply with changes in legal regulations. The initial development of the software product was completed by a team of developers from the corporate headquarters company (USSI) several years ago. All costs related to this product development were recorded on an internal development project U1 that was closed after the initial product development ended. Thereafter, all costs related to product updates and changes are tracked in a separate project U2. In order to run & treat the internal product development team as a profit center and not a cost center, the corporate management decided that the subsidiaries that make use of and sell the software product need to pay a fraction of their sales revenue to the corporate headquarters as a license fee. All respective intercompany contracts have been signed and need to be applied in the ERP system. How this application can be realized in standard Dynamics AX will be subject of this post. Before digging into details, let’s have a quick look at the following illustration that shows the different companies and projects involved in this scenario.  Part B: System setup Setup B.1: Intercompany dummy vendor account company FRSI & GBSI Similar what has been shown in the prior post on intercompany costs allocations, the first thing that needs to be setup are intercompany dummy vendor accounts. The only difference to what has been described in the previous post is that two rather than a single dummy vendor account need to be setup. Setup B.2: IC customer & vendor accounts The second setup step is also identical to the one shown in the prior post. However, slightly different from before, intercompany customer accounts need to be setup in the subsidiaries FRSI & GBSI and two separate intercompany vendor accounts in the corporate headquarters company USSI. Setup B.3: Project category setup The third setup step relates to the project category setup, which is required for the intercompany invoicing and transaction recording. Different from before, this time, two separate project categories – one for each subsidiary – need to be established because the project ledger posting setup in the project module does not allow a separation based on the company account.  Please note both categories are linked to the transaction type “expense”. Setup B.4: Procurement category setup company FRSI/GBSI Also the setup of the procurement categories is mainly identical to the setup that has been shown in the previous post except that two rather than a single procurement category need to be setup – one for each subsidiary.  Setup B.5: Project setup companies The project setup in the different companies involved in the intercompany scenario follows the structure shown in the graphic of the initial scenario section above. The next screen-prints exemplify how the corresponding projects are setup in the headquarters (USSI) and subsidiaries companies (FRSI & GBSI).   As mentioned in the prior post on intercompany cost allocations, there is nothing that requires special attention when setting up the different projects except that each of those projects should be linked to a default intercompany financial dimension value – at a minimum. Setup B.6: Project posting setup In regards to the project posting setup, reference can be made to what has been mentioned in the prior post except that the direction of the setup is flipped. That is, while intercompany revenue accounts need to be setup in the subsidiary companies (FRSI & GBSI), intercompany cost accounts need to be setup in the headquarters company. The same holds for the setup of the ledger posting integration for the procurement categories. Part C: Process steps Step C.1: Record transactions & invoice the external customer in FRSI/GBSI Against the background of those setups, the first process step consists of recording costs and revenues on the external customer projects that are run in the subsidiary companies. For reasons of simplicity and brevity only hour transactions are recorded and subsequently invoiced for a single project in each of the subsidiary companies. The next screen-print shows the vouchers created in company FRSI for the time recorded and invoiced.  As the vouchers created in company GBSI are basically identical to the one created in company FRSI, they are not explicitly illustrated here to conserve space. They are, however, included in the next accounting overview.  (IC = Intercompany financial dimension, PRO = Project financial dimension) The prior accounting overview shows ordinary project accounting transactions that debit a project cost account for the hours recorded and credit the payroll allocation account for the cost of those hours recorded. The second vouchers record the receivable against the external customer and credit a project revenue account (highlighted in yellow color). Step C.2.: Record internal vendor invoice in FRSI/GBSI Whereas most of you have seen and are familiar with the first process step, you might not have seen the following second one that posts an internal transaction on a dummy vendor account. Slightly different from the prior post where only a single line was used to create a transaction on the internal dummy vendor account, this time two lines are recorded and posted. The first line is used to record an expense on the external customer project – in the screen-print below – in company FRSI. This expense transaction represents the license costs charged by the corporate headquarters to the subsidiary for using the developed software product.  The second line is used for the subsequent creation of the intercompany credit note and consequently entered with a negative quantity & amount. Please note that this second line links to the support & maintenance project in company USSI.  Note: Whereas recoding such internal transactions is feasible in situations where a limited number of external customer projects exist, it becomes infeasible in companies that run many external customer projects. What might help in those cases is the standard Excel-Addin for Dynamics AX that allows importing transactions into the invoice workbench form shown above. The voucher resulting from posting the internal transaction can be identified in the next screen-print and is summarized in the next accounting overview.   The first notable outcome that can be identified from above is that no open vendor position is created on the internal dummy vendor account, as the two lines recorded offset each other. In addition, the debit account transaction on the ledger accounts 707451 (FRSI) and 402451 (GBSI) – that represent the license costs for the use of the software product developed by the corporate headquarters (USSI) – lower the profit for those projects and allow project managers taking a look at the full costs of their projects. The next screen-print, which shows the project statement for the external customer project in company FRSI shows this in more detail.  Step C.3.: Create intercompany credit note in FRSI/GBSI The third process steps consists of creating the intercompany project invoices (credit notes) in company FRSI and GBSI. As this step mirrors the one shown in the previous post, reference can be made to what has been said there.   The voucher that results from posting the intercompany project invoice (credit note) can be identified in the next screen-print.  As before, the next accounting overview summaries the postings recorded thus far.  Please note that the accounts highlighted in light-grey color offset each other and do thus not exert an influence on the project and corporate profitability in the subsidiary companies. Step C.4.: Post pending credit notes in USSI The last process step described in this post consists of posting the pending vendor invoices (credit notes) in the corporate headquarters company USSI shown in the next screen-print.  Posting those credit notes results in vouchers that debit – and therefore reduce – an intercompany liability account and credit an intercompany P&L account. For that reason, the profit in the corporate headquarters company increases correspondingly.  The next accounting overview summarizes all transactions recorded within the four process steps shown above.  The yellow-highlighted arrows and fields illustrate that a part of the revenue from the external customer projects in the subsidiaries (FRSI & GBSI) is shifted to the corporate headquarters company that developed the overall software product sold to the customer. With this revenue shifted to the support & maintenance project in the headquarters company, a comparison of the initial development cost and the ongoing maintenance costs of the developed software product with the resulting license revenues can be made. This is a major prerequisite for treating the internal development team / project as a profit center. Summary Within this and the previous posts I illustrated how indirect costs can be allocated to projects – either within a single company or between companies – by using standard Dynamics AX functionalities. The major outcome of those posts is that the standard Dynamics AX tools do in general support all kinds of those project allocation scenarios require, however, the one or the other system modification in order to get the allocations fully automated. Filed under: Project Tagged: cost allocations projects, indirect costs, intercompany, overhead Источник: https://dynamicsax-fico.com/2016/11/...allocations-3/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

|